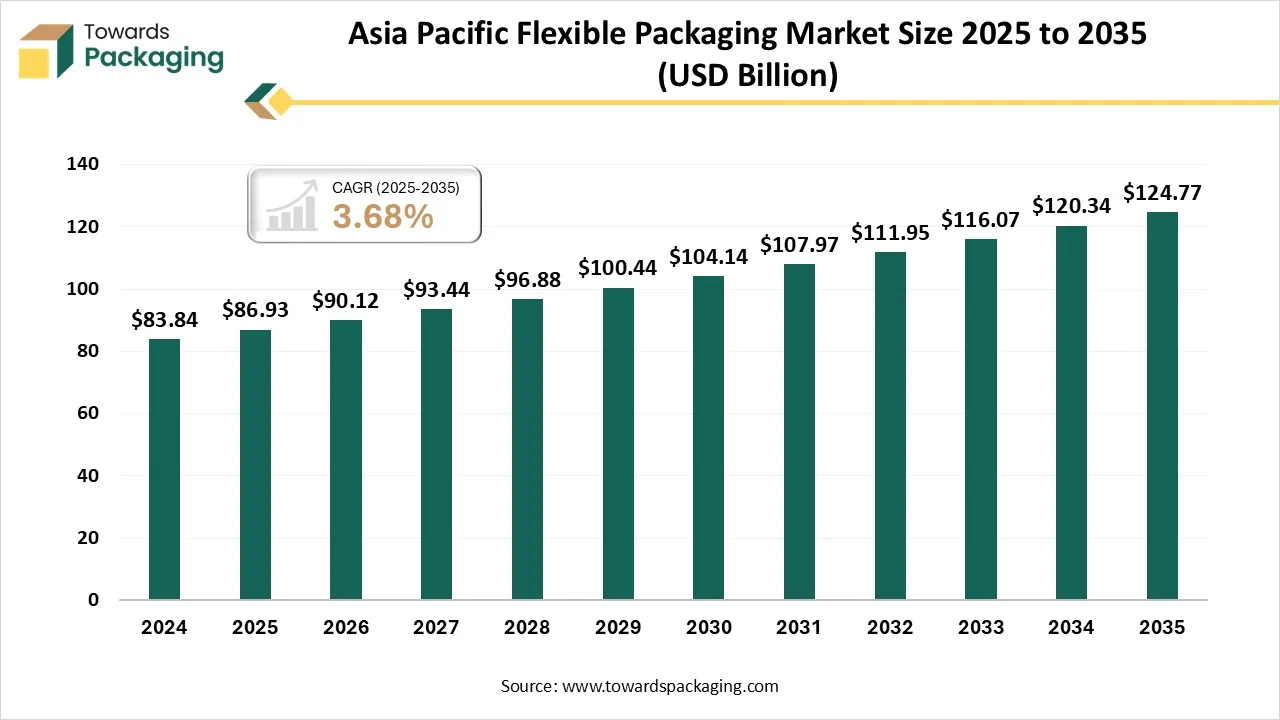

Ottawa, Jan. 14, 2026 (GLOBE NEWSWIRE) -- The global Asia Pacific flexible packaging market reported a value of USD 86.93 billion in 2025, and according to estimates, it will reach USD 124.77 billion by 2035, as outlined in a study from Towards Packaging, a sister firm of Precedence Research. The Asia-Pacific flexible packaging market is experiencing robust growth, driven by rapid urbanization, expanding food and beverage consumption, and rising demand for convenient, lightweight packaging solutions.

| What is meant by Flexible Packaging in the Asia Pacific?

The Asia-Pacific flexible packaging market is driven by rapid urbanization, growing food and beverage consumption, rising e-commerce activities, changing lifestyles, and increasing demand for cost-effective, lightweight packaging solutions. Flexible packaging refers to packaging materials made from plastic, paper, aluminum, or combinations that can easily change shape, offering benefits such as convenience, extended shelf life, reduced material usage, and efficient transportation.

| Asia Pacific Government Initiatives for the Flexible Packaging Industry:

China’s New Recycled Plastics Standards (2026): Starting February 1, 2026, nine national standards will enforce stricter recyclability in packaging design, requiring manufacturers to reduce the use of labels, adhesives, and metal components.

India’s National Packaging Initiative: This comprehensive program establishes design guidelines and promotes "Make in India" for sophisticated materials, focusing on infrastructure like specialized logistics parks and packaging testing labs.

Australia’s National Packaging Targets (2025-2026): This initiative mandates that 100% of packaging be reusable, recyclable, or compostable by 2025, with ongoing 2026 consultations to introduce mandatory national standards and formal EPR schemes.

Malaysia’s Mandatory EPR Implementation (2026): Building on its Plastic Sustainability Roadmap, Malaysia plans to transition its currently voluntary Extended Producer Responsibility (EPR) scheme to a mandatory requirement for all producers by 2026.

Singapore’s Beverage Container Return Scheme (2026): Launching in 2026, this initiative uses deposit return systems and smart bins to increase the recovery rates of aluminum and plastic containers for recycling.

Vietnam’s Environmental Protection Law Eco-Labeling: Under this reinforced regulatory framework, Vietnam enforces strict reduction targets and eco-labeling for packaging materials to promote bio-based and sustainable alternatives.

South Korea’s Mandatory Recycled Content Mandate (2026): Beginning in 2026, the government will require a minimum of 10% recycled content in plastic (PET) bottles to drive demand for the local recycling industry.

| What Are the Latest Key Trends in the Asia Pacific Flexible Packaging Market?

1. Sustainable & Eco-Friendly Materials

Brands and manufacturers are rapidly shifting toward recyclable, biodegradable, and mono-material films to meet rising environmental concerns, government regulations, and consumer demand for greener packaging. These solutions reduce waste and support circular-economy goals while maintaining product protection.

2. E-Commerce-Driven Packaging Growth

The boom in online retail and food delivery across Asia-Pacific fuels demand for lightweight, cost-effective, flexible packaging that protects products during transit. Pouches, stand-up bags, and mailers are increasingly used to meet logistical needs and improve customer experience.

3. Smart & Interactive Packaging Technologies

Incorporating QR codes, NFC tags, and other smart features enhances traceability, product information access, and consumer engagement. Smart packaging also supports quality monitoring and freshness indicators, appealing especially in food and healthcare segments.

4. Customization & Branding Focus

Customized flexible packaging designs help brands differentiate on crowded shelves and enhance unboxing experiences. Digital printing and tailored formats let companies create unique, consumer-centric packaging that builds loyalty and reinforces brand identity.

5. Advanced Barrier & Performance Structures

There’s rising adoption of high-barrier films and advanced material structures that extend shelf life and protect sensitive products. These innovations support longer freshness for food, pharmaceuticals, and personal care products while meeting demanding regulatory standards.

6. Lightweighting & Material Efficiency

Focusing on reducing material usage without compromising durability helps cut costs and carbon footprint. Lightweight flexible packages lower shipping expenses and improve sustainability outcomes, aligning with corporate and regulatory goals.

| What is the Potential Growth Rate of the Asia Pacific Flexible Packaging Industry?

The growth of the Asia-Pacific flexible packaging industry is driven by rapid urbanization, population growth, and rising disposable incomes, which increase demand for packaged food, beverages, and consumer goods. Expanding e-commerce and food delivery platforms boost the need for lightweight, durable, and cost-efficient packaging. Growth in pharmaceutical and healthcare production further supports market expansion.

Additionally, changing consumer lifestyles favour convenience, portability, and extended shelf life. Strong manufacturing capabilities, especially in China, along with technological advancements in barrier films, digital printing, and sustainable materials, continue to accelerate adoption across diverse end-use industries.

| What made the Pouch Segment Dominant in the Asia Pacific Flexible Packaging Market in 2024?

The pouch segment dominates the market due to its lightweight nature, cost efficiency, and excellent barrier protection. Pouches offer convenience, resealability, and extended shelf life, making them ideal for food, beverages, and personal care products. Their compatibility with e-commerce logistics and attractive branding options further strengthen widespread adoption across the region.

The bags segment is the fastest-growing segment in the market due to rising demand for convenient, lightweight, and cost-effective packaging solutions. Strong usage in food, agriculture, retail, and e-commerce applications, along with easy handling, bulk storage capability, and improved durability, continues to drive rapid adoption across developing economies in the region.

| How the Plastic dominate the Asia Pacific Flexible Packaging Market in 2024?

The plastic material segment dominates the market due to its versatility, durability, and cost efficiency. Plastic offers excellent barrier properties, flexibility in design, and compatibility with various packaging formats such as pouches and bags. Its lightweight nature, ease of mass production, and suitability for food, pharmaceutical, and consumer goods applications further drive widespread adoption across the region.

The paper segment is the fastest-growing material segment in the market due to rising environmental awareness and preference for sustainable, recyclable packaging. Government regulations limiting plastic usage, growing adoption of paper-based laminates, and increasing demand from food, beverage, and retail sectors further accelerate paper material adoption across the region.

| What made the Food & Beverage Segment Dominant in the Asia Pacific Flexible Packaging Market in 2024?

The food & beverages segment dominates the market due to high consumption of packaged and processed foods driven by urbanization and busy lifestyles. Flexible packaging offers extended shelf life, freshness preservation, convenience, and cost efficiency. Rising demand for ready-to-eat meals, snacks, beverages, and online food delivery further supports strong adoption across the region.